The Wealth Manager’s Perfect Storm of Risk, Part 2

If you missed Part 1 of The Wealth Manager’s Perfect Storm of Risk, click here.

One of our biggest jobs as wealth managers is to protect our clients from unnecessary risk. The tools we use to diversify, allocate, rebalance and tax harvest have radically evolved in recent years.

In Part 1 of this blog series about risk, we talked about the “Perfect Storm” created by 3 intensifying risks that will impact your aging clientele’s retirement outcome:

- The 8-Year-Old Bull Market

- The End of the Bond Bull Market

- The Hidden Risks of Longevity

Here’s what industry thought leader Michael Kitces said on his blog about how annuities with guaranteed lifetime income may fit into a retirement income portfolio:

“One of the hardest risks to manage in retirement is the uncertainty of longevity – how long the retiree will live, and therefore how long of a retirement time horizon needs to be planned for? Planning for too short of a retirement time horizon can lead to asset depletion if the retiree actually lives. Planning for too long leads the retiree to unnecessarily constrain retirement spending for a future that never occurs.

The benefit of using longevity insurance (annuities with guaranteed lifetime income) as part of a retirement portfolio is that it helps to solve the unknown time horizon problem.”1

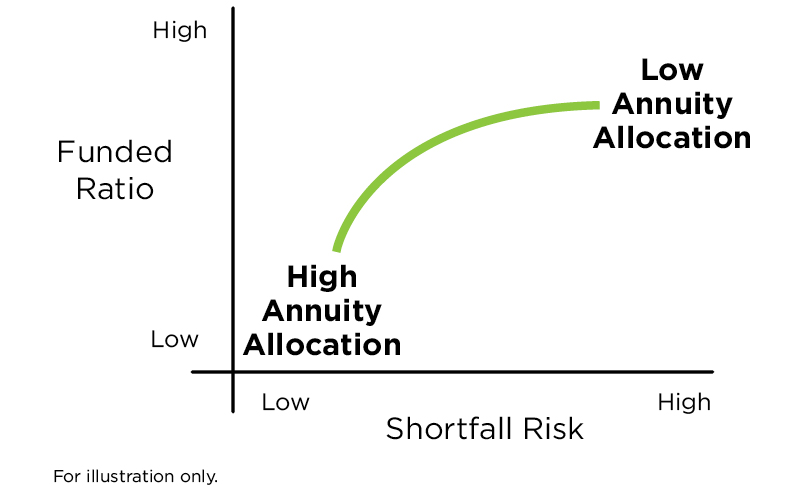

Efficient Income Frontiers

We are all familiar with the efficient frontier for optimizing portfolios. In the early 2000’s, the folks at Ibbotson evolved the concept of an efficient frontier for retirement income portfolios by incorporating longevity and income into the portfolio optimization model. Using efficient income frontiers gives wealth managers a valuable allocation tool for integrating annuities into a client’s retirement portfolios.

Retirement Income Efficient Frontier

David Blanchett, Director Retirement Research, Morningstar Associates LLC, Annuities and Retirement Income, March 18, 2014

Dr. Wade Pfau offered this assessment, “This is the basis of my research on mathematical optimization. In the February 2013 Journal of Financial Planning article, “A Broader Framework for Determining an Efficient Frontier for Retirement Income,” I focused on how to best meet two competing financial objectives for retirement: satisfying lifetime spending goals and preserving financial assets.

Among the assets I considered in the article were stock funds, bond funds and income annuities. The article built on earlier work by Moshe Milevsky and Peng Chen on the efficient frontier for retirement income, which extended the efficient frontier of Modern Portfolio Theory from a single-period to a lifetime focus. There can be a trade-off between these objectives, as locking in spending or reducing portfolio volatility to protect on the downside generally means sacrificing some of the potential growth on the upside. Product allocation considers how different combinations of stocks, bonds and annuities perform in meeting these two objectives. Efficient allocations will do a better job at meeting both of the lifetime objectives.

My simulations showed that the efficient frontier for retirement income generally consists of combinations of stocks and income annuities. Perhaps surprisingly, bond funds did not make it to the frontier; they do not serve a useful role in the optimal retirement income portfolio.”2

As our clients transition into the retirement life stages, market risks are magnified by withdrawals and longevity risk. Delivering Retirement Alpha addresses these risks.

Let’s talk about another evolution in the wealth manager tool box – Retirement Alpha. Retirement Alpha is the value an advisor brings to the client relationship through retirement income planning, strategies, products and behavioral coaching to help clients achieve better outcomes. Retirement Alpha addresses longevity risk through the use of guaranteed lifetime income.

Retirement Alpha represents the kind of strong, differentiating value proposition that can be transformative.