The advisor’s paradigm has evolved, has your marketing kept up?

Which advisor paradigm are you serving? If you’re a financial institution that is dependent on growing relationships with financial advisors, this is a critical question.

I don’t need to explain Snapchat filters to my 30-year-old nephews. But I’m not sure it would be the same conversation with my 88-year-old Dad. The same principal applies here. The business paradigm for financial advisors has evolved in the last few years. How you should approach them and what they might expect from their strategic partners differs depending on where they are in this evolution.

So, what are those paradigms?

We recently hosted Norm Trainor, the founder and CEO of the Covenant Group, on a thought leadership webinar for one of the nation’s top independent distribution companies. Over the last 20 plus years Norm has built a powerful best practices-driven platform for improving advisor performance and productivity.

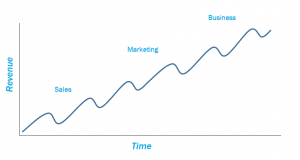

He shared a lot of key insights, but one really jumped out. He shared this simple image of how the advisor’s business paradigm has changed.

Over the last few decades, the advisor’s business model has progressed from product sales to marketing a service by offering advice to building a sustainable, scalable business by offering a superior experience. The business focus has changed from selling product to selling advice to the selling the experience. The advisor pain points and personas for each paradigm are each a little different.

So, here’s the question: which advisor persona are you targeting and which paradigm does your value chain serve?

We were on a call earlier this week with a very successful advisor who lives in the “sales” paradigm. He cares deeply about his clients but in his words “I’m a one call closer.” The group he works with is evolving and is targeting the “sustainable business” paradigm. So, they have one foot at each end of this evolution. This is true for many institutions actively soliciting and serving this financial advisor space. They find themselves trying to hang on to their legacy business while stepping into a new segment of advisors.

It’s about an experience.

You’ve heard the adage, “If you stand for everything, you stand for nothing.” That’s a good starting point for the answer. There’s also a question of authenticity. How do you authentically say you’re the best for everyone? So, whichever segment(s) you’re targeting, they need to feel as though they are genuinely the “object of your desire.” Your messaging and your customer experience will demonstrate that to them.

Staying connected to those legacy segments requires an intentional process of relevant communication and collaboration by your team.

Here’s another reason to have a target segment: Focus improves your experience. With an ideal advisor-client in mind, you can deliver the experience those target clients desire. The impact?

Only 16% of C-level customers chose a vendor because of their product. Instead, what buyers want is a stellar sales experience where they can learn something new, and marketing content that educates and makes them smarter.[1]

What customers really want from your organization is help solving their problems. They want to hear what other customers were able to achieve by using your solution. They want to understand the value and benefits your products promise to deliver, not just the product itself.

For an organization in transition, the solution is to express your forward-looking value while embracing your legacy business. Segment your communication so that legacy stakeholders are not forgotten. But commit to the strategy of targeting your ideal advisor-client by building an experience that resonates and differentiates.

So, here’s the question: who is your target audience and how does your value prop align with that audience?

So how do you add value to your advisor-clients?

Once you embrace these concepts, one easy build for you would be to offer your advisor audience the insight and training so that they can apply these same concepts of segmenting, targeting and communicating to their consumer audience.

Where does an advisor find sustainable business growth?

Investment News latest Study of Pricing and Profitability offers this data: Advisor AUM grew by 18.6%. But the traditional driver of growth, referrals of all kinds, represented just 4.3% and business development activities added 4.9% to the surveyed advisors’ growth. The largest contributor to growth was positive investment performance which accounted for 8.3% AUM growth.[2] That spells opportunity.

The easiest way for an advisor to improve their organic growth and profitability is to align their communication and value chain with their ideal client. For proof, see the Schwab research[3] which recently reported that the most successful RIAs in terms of growth and profitability have documented these elements and execute accordingly. It’s a key driver of their success.

Two of the most important steps in a business’ value chain are casting a clear picture of your ideal clients and building a powerful value proposition that differentiates you from your competition while motivating those ideal prospects to engage. The challenge is doing that in an ever-evolving market.

EAG is helping leading organizations systematically improve their marketing results by defining targets and personas. Aligning targets and the client experience with content and rich media is an important contribution we are making to the most successful organizations.

[1] Value-ology Palgrave McMillan, 2017.

[2] https://www.investmentnews.com/dcce/20180925/4/4/wp_research/3523191

[3] Guiding Principles, Schwab Advisor Services, June 2018